Post Category - Giving BirthGiving Birth - Post Category - Doctors & HospitalsDoctors & Hospitals

Post Category - Giving BirthGiving Birth - Post Category - Doctors & HospitalsDoctors & Hospitals Post Category - ExpertsExperts - Post Category - Finance & InsuranceFinance & InsurancePost Category - FeaturedFeatured

Post Category - ExpertsExperts - Post Category - Finance & InsuranceFinance & InsurancePost Category - FeaturedFeaturedKeen to get maternity insurance but unsure where to start? Here’s what mamas-to-be need to know!

Maternity Insurance is one of those mysterious things that we all know is good to have (in fact, it’s basically a necessity to cover the unexpected – which is pretty much pregnancy and parenthood in a nutshell).

But how does one go about choosing a plan, and what, exactly, are the requirements? And what does maternity insurance actually cover, anyway?

We spoke with the experts at award-winning AXA to get the lowdown.

Get Covered Before You Get Pregnant

With annual deductibles starting at as little as $700 along with a 20% co-pay, AXA InternationalExclusive is a fab plan for expats that provides a high level of international medical care, no matter where you are. Whether you’re at one of Singapore’s top-notch private hospitals, traveling internationally for work, or visiting home country, you’re well covered for every eventuality, mama.

The plan covers up to $22,000 in pregnancy and delivery costs (provided you’ve already had continuous coverage under Plan A for at least 365 days — this part is crucial, mama). If you’ve been on Plan A for a minimum of 18 months, you can even receive up to $2,500 worth of infertility tests and treatments. Even if you don’t sign up for coverage at least a year before giving birth, your newborn’s hospital accommodation will still be covered. We suggest signing up for a hospital’s birthing package as the most affordable alternative, mama.

Costs to Expect When You’re Expecting

Doctor Visits: At the bare minimum, even with a totally uneventful low-key pregnancy, you can look forward to lots of doctor’s visits (with increasing frequency in the last couple months and weeks). The average OBGYN visit costs between $75-$150 for a basic visit, but throw in scans and we know people who pay upwards of $500 for a single visit. Yowch!

Scans: Just for reference, a standard pregnancy without any complications will require 3-4 ultrasounds, which in Singapore typically range from about $100 to $250 apiece.

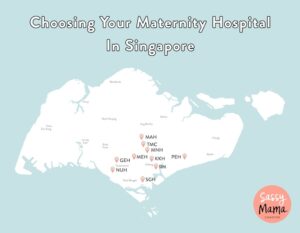

Hospital costs: You’ll find a wide range of hospital accommodation options, starting with whether you opt to go public or private, along with what kind of room you choose. Of course, that’s only the beginning. Costs vary immensely depending on whether you have a “normal” birth, or require a medically necessary C-section. According to the Ministry of Health, the average cost of a “normal” vaginal stay in a single room ranged from $3,580 to upwards of $11,000 depending on the hospital, with C-Section rates starting at around $7,000 at public hospitals and only going up from there. You can rest easy knowing that AXA InternationalExclusive covers single room accommodation!

Coverage Once Baby Arrives

What’s more, when the parent of a newborn baby is already continuously covered under an AXA InternationalExclusive policy Plan A for at least 365 days, the baby can be easily added with additional premium to the same plan as the parent’s policy and enjoy cover straight from birth. Whew! At least that’s one less thing to worry about when a baby shows up to turn your life upside down!

Newborn cover also accounts for unanticipated acute medical conditions (such as premature birth, jaundice, colic, etc.) that may require a stay in the NICU or extra care; the plan also provides up to $65,000 worth of coverage for congenital conditions.

AXA InternationalExclusive also has a unique pre-existing conditions benefit that provides coverage for conditions that are pre-existing, so long as they’re declared on the application form. With a full suite of coverage, it’s excellent for papas as well as mamas!

AXA Singapore is now offering all mamas and mamas-to-be who sign up for AXA InternationalExclusive a Home or Personal Accident Plan for FREE! The promotion runs through 16 June, 2017 so sign up soon, mama! You can look forward to plenty of other perks as your baby grows, too: first of all you’ll get a 10% family discount when your policy covers 3 or more family members, and young children can be covered for both primary and specialist care, including those frequent early days visits to the paediatrician! Throw in vaccinations, health screens and alternative treatments coverage, and it’s a whole lot of headaches off your plate, mama.

![]()

Want to find out more? (We know, this stuff is confusing and you want to get it right!) Contact AXA today to get a quote, mama!

View All

View All

View All

View All

View All

View All

View All

View All

View All

View All

View All

View All

![[𝗦𝗔𝗩𝗘 𝗧𝗛𝗜𝗦] 𝗞𝗶𝗱-𝗔𝗽𝗽𝗿𝗼𝘃𝗲𝗱 𝗗𝗲𝘀𝘀𝗲𝗿𝘁 𝗦𝗽𝗼𝘁𝘀 𝗬𝗼𝘂 𝗖𝗮𝗻 ‘𝗘𝗮𝘁 𝗳𝗼𝗿 𝗙𝗿𝗲𝗲’ 𝗪𝗶𝘁𝗵 𝗖𝗗𝗖 𝗩𝗼𝘂𝗰𝗵𝗲𝗿𝘀! 🍦🍩🧁😉

Before you ask “Can use CDC voucher?” Yes, you definitely can! These spots are perfect for an after-school treat, weekend fun, or just saying “yes” to dessert without saying goodbye to your wallet.

Comment “Sweet” or tap the link in bio for more foodie recommendations!

Got a fave kid-friendly spot that accepts CDC vouchers? Let us know in the comments too!

.

.

.

.

.

.

.

#CDCVouchersSG #SGMumLife #KidFriendlySG #FreeDessert #HeartlandEats #SweetTreatsSG #SGParents #FamilyFunSG #WafflesAndIceCream #BudgetParenting #ThingsToDoWithKidsSG #SGCafes #SupportLocalSG #KidsEatHappy #CDCAdventures](https://www.sassymamasg.com/wp-content/plugins/instagram-feed/img/placeholder.png)